Application for registration. 2018 the Sales and Services Taxation SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 or 10 percent or a specific rate depending on the category of.

A specific rate of tax of RM 25 is imposed upon issuance of principal or.

. SST has kept corporates across Malaysia busy for the last three. SST Treatment in Designated Area and Special Area. Malaysia Service Tax 2018.

Direction to treat persons as. Annexure 2 Amendments to the Directives Effective. Short title and commencement.

Sales tax due Part IV REGISTRATION 12. The Malaysia Customs Department determine the amount of import duties and taxes based on several factors. Consequential to the Issuance of the Securities Commission Malaysias Guidelines on Contracts For Difference Guidelines Annexure 1 Amendments to the Guidelines.

What is SST Rate in Malaysia. The SST threshold for restaurants cafes canteens. SST in Malaysia was introduced to replace GST in 2018.

These are applicable for native labors who are actively serving various businesses in this country. The MOF announced on July 16 2018 that the Sales and Services Taxation SST is chargeable on the manufacture of taxable goods in Malaysia. The rate reduction from the current 6 to 0 will be reflected on transactions related to MYXpats charges from 1 June 2018 onwards.

Furtherance of business in Malaysia and is liable to be registered or is registered under the Service Tax Act 2018. Reminder for new application and pass renewals. 1st July 2018 Trading Participant Circular No.

What is the rate of tax for service tax. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come. Understand the income tax rate and type in Malaysia will help your business stay in good compliment.

Pick a star plan party hard with your squad from rm125 per month. Liability to be registered 13. Rate of sales tax 11.

Usually a business or service provider working under the Service Tax Act 2018 must register with the SST if the annual value of taxable services exceeds RM500000. The Employment Act 1955 Malaysia is the core legislation approved for the welfare and all relevant aspects of employee in Malaysia. LAWS OF MALAYSIA Act 806 SALES TAX ACT 2018 ARRANGEMENT OF SECTIONS Part I PRELIMINARY Section 1.

The current tax rate for sales tax is 5 and 10 while the service tax rate is 6. Best viewed in Google Chrome. The Sales and Service Tax SST will be implemented at MYXpats Centre beginning 1 November 2018.

Employment laws in Malaysia provides standard conditions for specific types of employees working in this nation. 4 Laws of Malaysia ACT 806 14. GST registered person who fulfilled the required criteria to be registered but were not registered by 1st September 2018 need to apply for registration within 30 days from the commencement date.

On 31 August 2018 GST was abolished and SST was implemented on 1 September 2018. The SST is also applied to the importation of taxable goods into Malaysia at the rate of 5 or 10 percent or a specific rate depending on the category of products. Sales and Service Tax SST in Malaysia.

Sales tax was reinstated on 1 September 2018 as Malaysia moved away from the former GST regime. The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018. As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt.

The proposed rate of tax is 6 and a specific rate for creditcharged card. If your company is already GST-registered the MySST system will automatically register your company for SST. Malaysia Sales Service Tax SST.

Amendments to the - 1. Malaysia Sales Tax 2018. Following are the SST Malaysia rates applicable to different goods and services.

Impacts Of Particulate Matter Pm2 5 On The Health Status Of Outdoor Workers Observational Evidence From Malaysia Springerlink

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

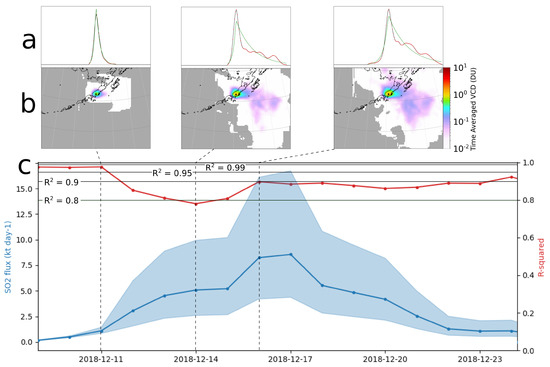

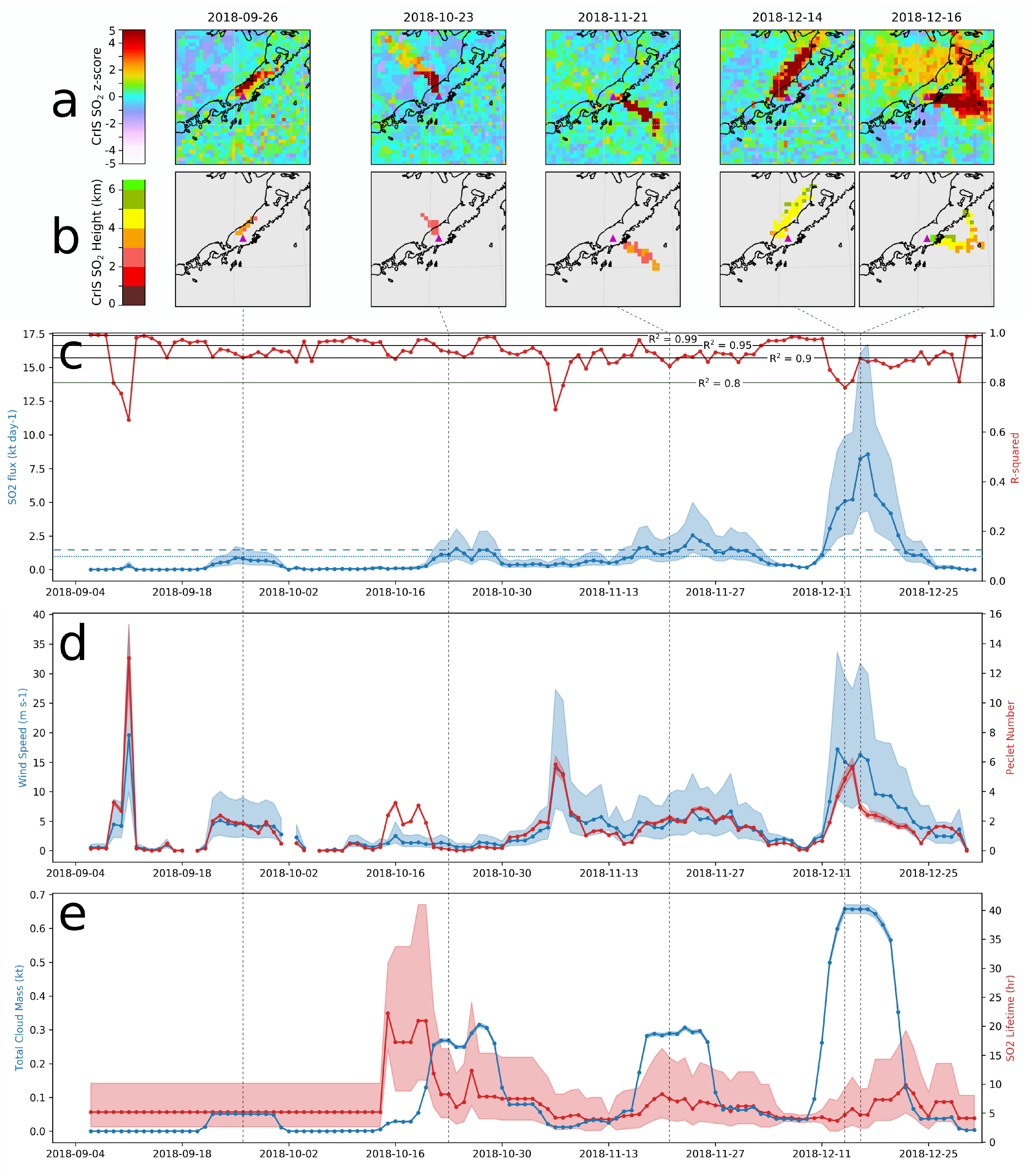

Remote Sensing Free Full Text A Novel Approach To Estimating Time Averaged Volcanic So2 Fluxes From Infrared Satellite Measurements Html

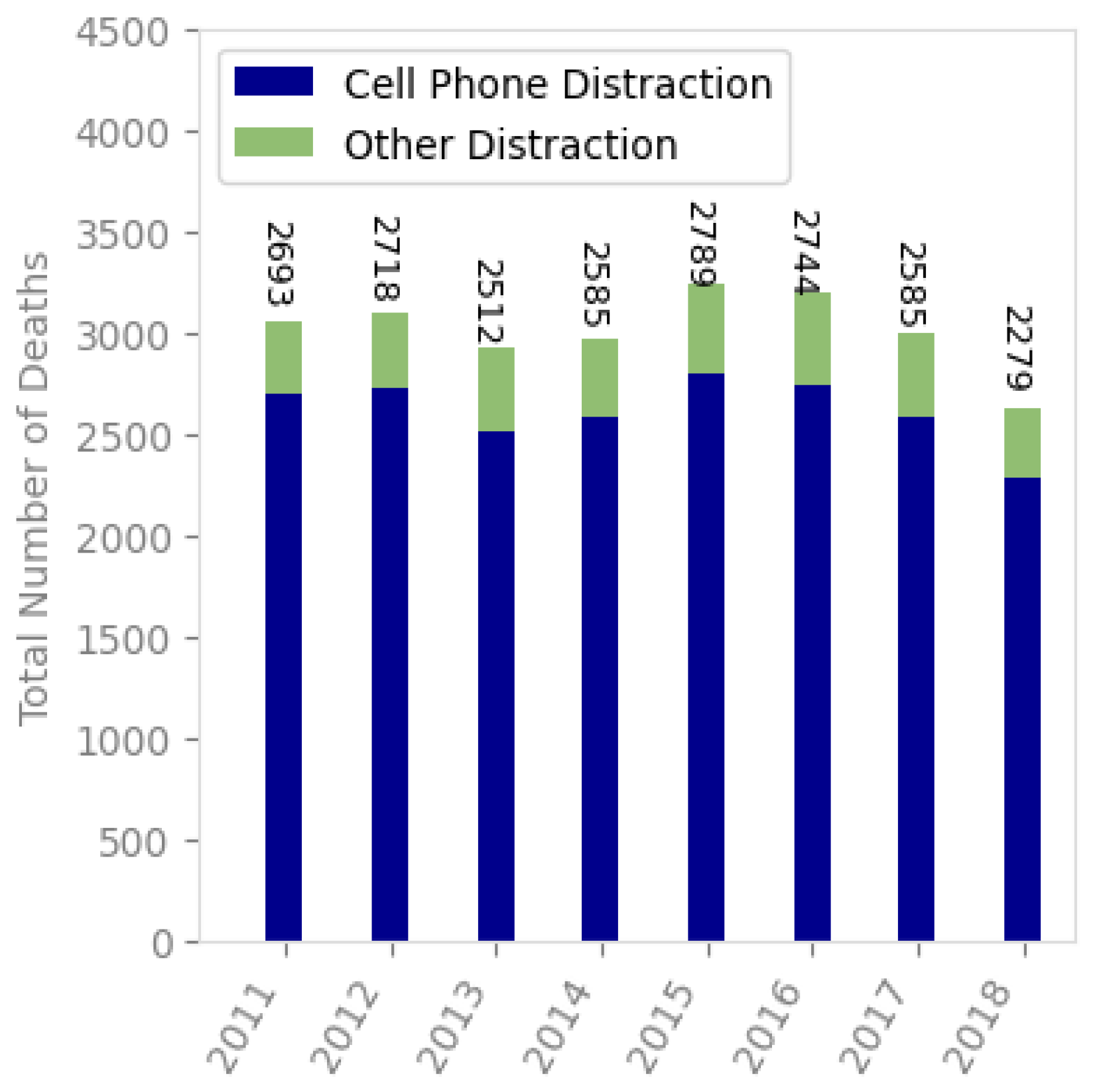

Applied Sciences Free Full Text Deep Learning Approach Based On Residual Neural Network And Svm Classifier For Driver Rsquo S Distraction Detection

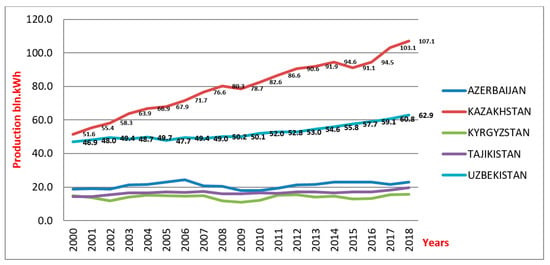

Energies Free Full Text Empirical Research On The Relationship Amongst Renewable Energy Consumption Economic Growth And Foreign Direct Investment In Kazakhstan And Uzbekistan Html

Fuzzy Modelling Of Benzene Health Risk Assessment In Khark Island Springerlink

1 Nov 2018 Budgeting Inheritance Tax Finance

Atmosphere March 2022 Browse Articles

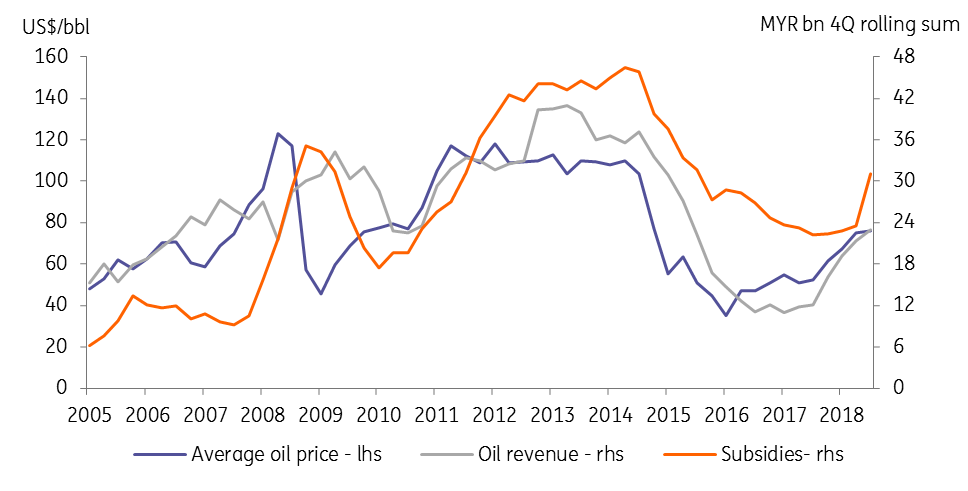

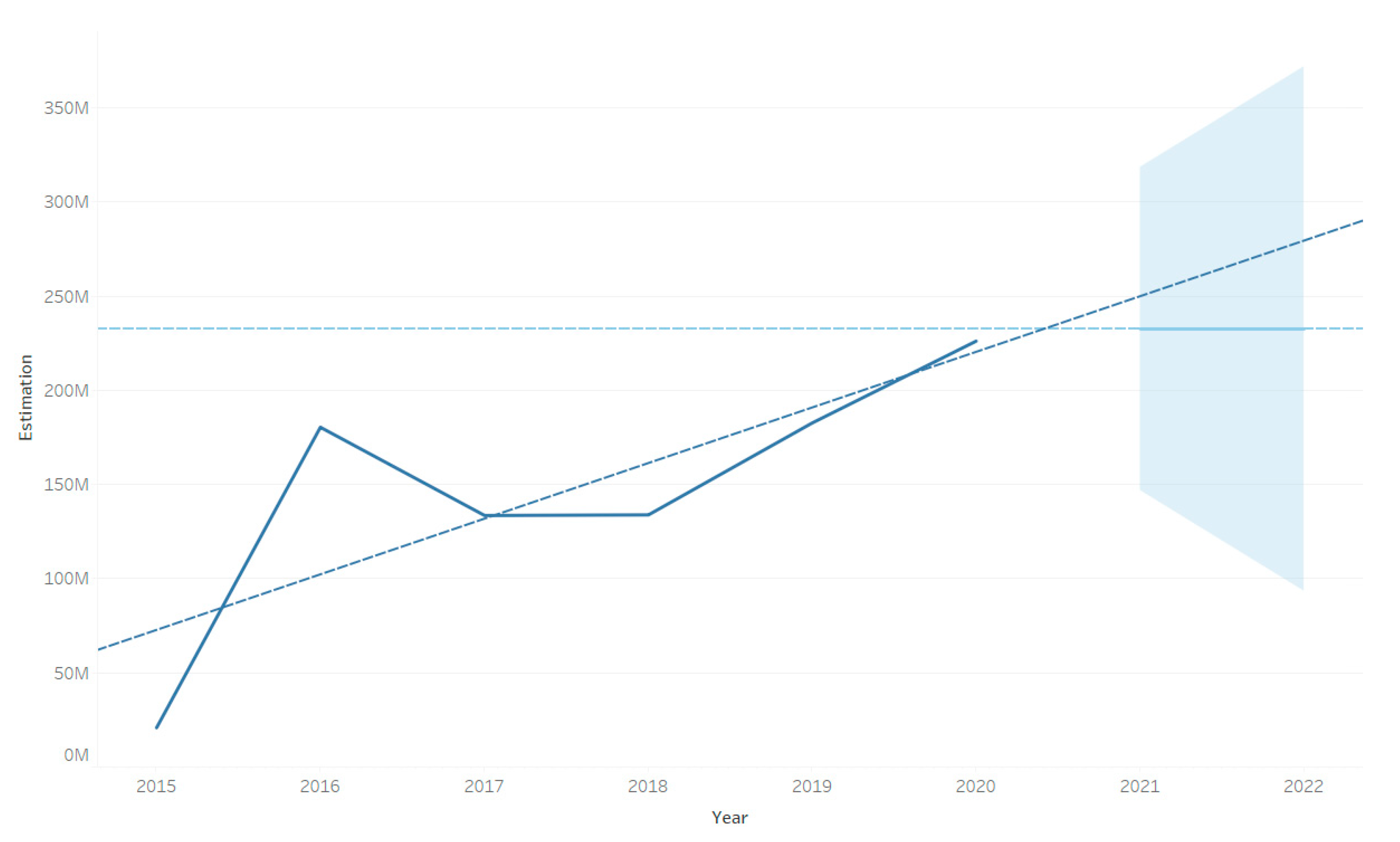

Malaysia 2019 Budget Preview A Derailed Fiscal Consolidation Article Ing Think

1 Nov 2018 Budgeting Inheritance Tax Finance

Energies Free Full Text Striving For Enterprise Sustainability Through Supplier Development Process Html

Remote Sensing Free Full Text A Novel Approach To Estimating Time Averaged Volcanic So2 Fluxes From Infrared Satellite Measurements Html

Energies Free Full Text Cryptocurrency Mining From An Economic And Environmental Perspective Analysis Of The Most And Least Sustainable Countries Html

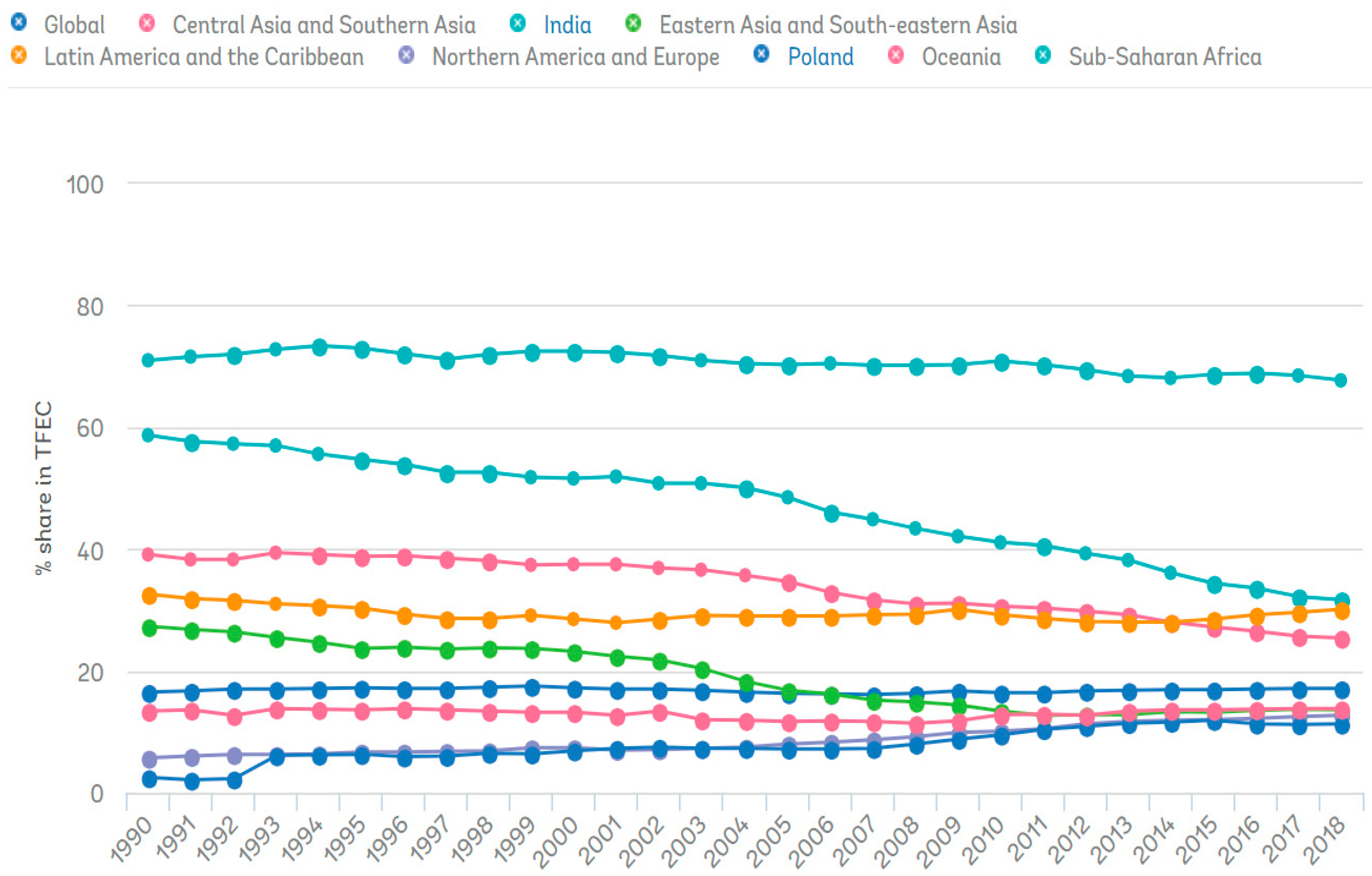

Energies Free Full Text Renewable Energy Decision Criteria On Green Consumer Values Comparing Poland And India Aligned With Environment Policy For Sustainable Development Html

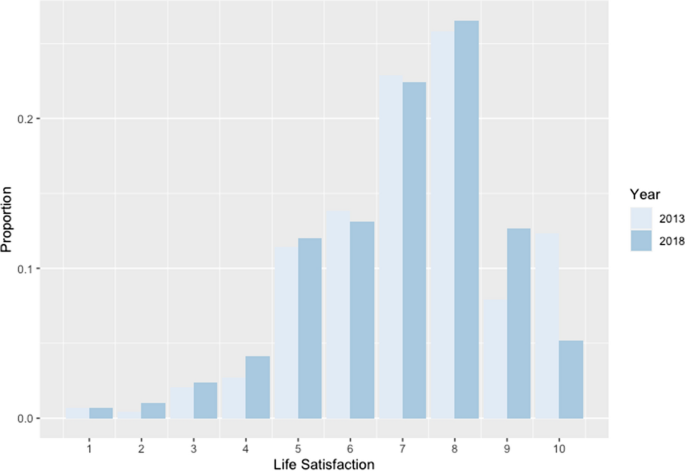

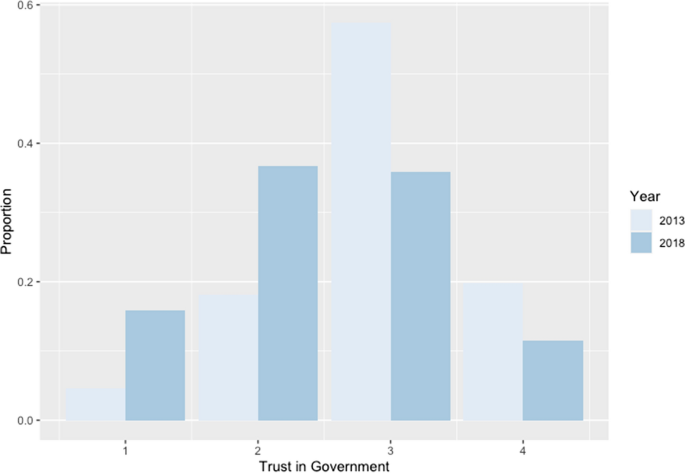

Life Satisfaction And Incumbent Voting Examining The Mediating Effect Of Trust In Government Springerlink

Life Satisfaction And Incumbent Voting Examining The Mediating Effect Of Trust In Government Springerlink

Calling All Senior Golfers Join In The Fun And Win Exciting Prizes Call Us Now For Bookings At 07 259 6152 3 Or Whatsapp Us At 0 Golf Resort Resort Golf